Financial Well-being

Welcome to Thriving-Baby-Boomers – A Whole person approach to wellness

“Empowering others to take a balanced approach to their own health and wellness by focusing on all aspects of the whole person.’

“Focusing on the whole person to maximize health and wellness for life.”

TBB logo

Financial Well-Being for Baby Boomers

According to some reports, it doesn’t look like there’s anything to worry about concerning the financial well-being of baby boomers. It is said that baby boomers were the wealthiest generation at that time, and received good levels of income during their working lives.

I know I’m not one of those wealthy baby boomers. I came from a working poor background and have struggled to make ends meet most of my life. But I really have come to believe that one’s mindset plays a huge part in whether they are rich or poor, wealthy or prosperous. I’ve been working for the last several years to improve my financial well-being by improving my mindset.

There are certain attitudes and actions that the wealthy have that most others don’t have. How is your financial well-being? Where do you sit on the Millionaire Mindset? (See my upcoming book review on this book and others listed below.)

It has been said that we are influenced by the five people closest to us. ‘Birds of a feather flock together. Or ‘Like attracts like.’ Who are you hanging out with?

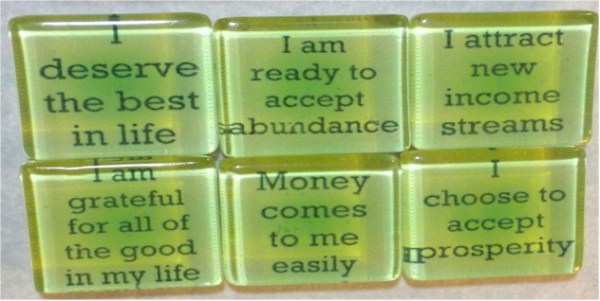

Financial Affirmations

Show Me The Money!!!

How much money is ‘enough’? Is there ever such a thing as ‘too much money? How and why do you feel that way?

Is there a difference between being rich and being wealthy? Some say that being rich is objective and based on comparisons to others, while wealth is more of a subjective experience that is solely up to the individual’s attitudes and perceptions.

What do you think? Please fill in the online form and let us know YOUR definition of rich vs. wealth, and any tips or tricks you use in creating financial well-being in your life.

Comfort Levels about Money

I recently heard of a study where the researchers looked at two groups of realtors in a city to see if they could figure out what determines ‘success.’ They looked at the areas of the city with high priced/high valued properties, and areas of the city with lower-valued properties. The researchers predicted that realtors would perform better who had high-valued properties to sell and those realtors that had lower-valued properties would have less income than the other group.

The researchers identified the highest-performing salespersons and the lowest-performing salespersons in each neighbourhood. They wondered if they could raise up the income level of the low-performing salespersons by putting them in a higher-valued property neighbourhood, and if the higher-performing salesperson’s sales would decrease in a lower-valued neighbourhood.

What the researchers found actually astounded them that the low-performing salespersons’ performance and sales actually went down in a short period of time, and the high-performing salespersons were able, over time, to raise their income levels back to peak sales even though they were in a poorer valued neighbourhood.

Like Henry Ford said, “Whether you think you can, or you think you can’t–you’re right.”

Do You Have Enough Money For:

Money Tree

Some ways to improve one’s financial well-being are:

Books That Have Helped Me in My Pursuit of Financial Well-Being

Please click on any link to read my book review

- The Wealthy Barber: the common sense guide to successful financial planning by David Chilton

- Sacred Commerce: Business as a path of awakening by Matthew & Terces Engelhart

- The Secrets of the Millionaire Mind: mastering the inner game of Wealth by T. Harv Eker

- One Minute Millionaire: the enlightened way to wealth by Mark Victor Hansen and Robert G. Allen

- Five Wealth Secrets 96% of Us Don’t Know by Craig Hill

- Wealth, Riches & Money: God’s Biblical Principles of Finance by Craig Hill and Earl Pitts

- The Master-Key to Riches by Napoleon Hill

- Think and Grow Rich by Napoleon Hill

- Working ‘with’ The Law by Raymond Holliwell

- Rich Dad, Poor Dad by Robert Kiyosaki

- Busting Loose from the Money Game by Robert Scheinfeld

- Be Smart With Your Money by Chris Snyder

STANDARD DISCLOSURE: In order for me to support my blogging activities, I may receive monetary compensation or other types of remuneration for my endorsement, recommendation, testimonial and/or link to any products or services from this blog. Please note, that I only ever endorse products that are in alignment with my ideals and I believe would be of value to my readers.

According to T. Harv Eker, “If you want to change the fruits, you will first have to change the roots. If you want to change the visible, you must first change the invisible.’

Today I affirm:

I AM a money magnet.

Return Home

Copyright © 2012 – 2022 thriving-baby-boomers.com. All rights reserved.

This website is for information purposes only and is not intended to be, or to serve as, a substitute for legal, financial, or medical advice, diagnosis or treatment. Always seek professional advice.

Recent Comments